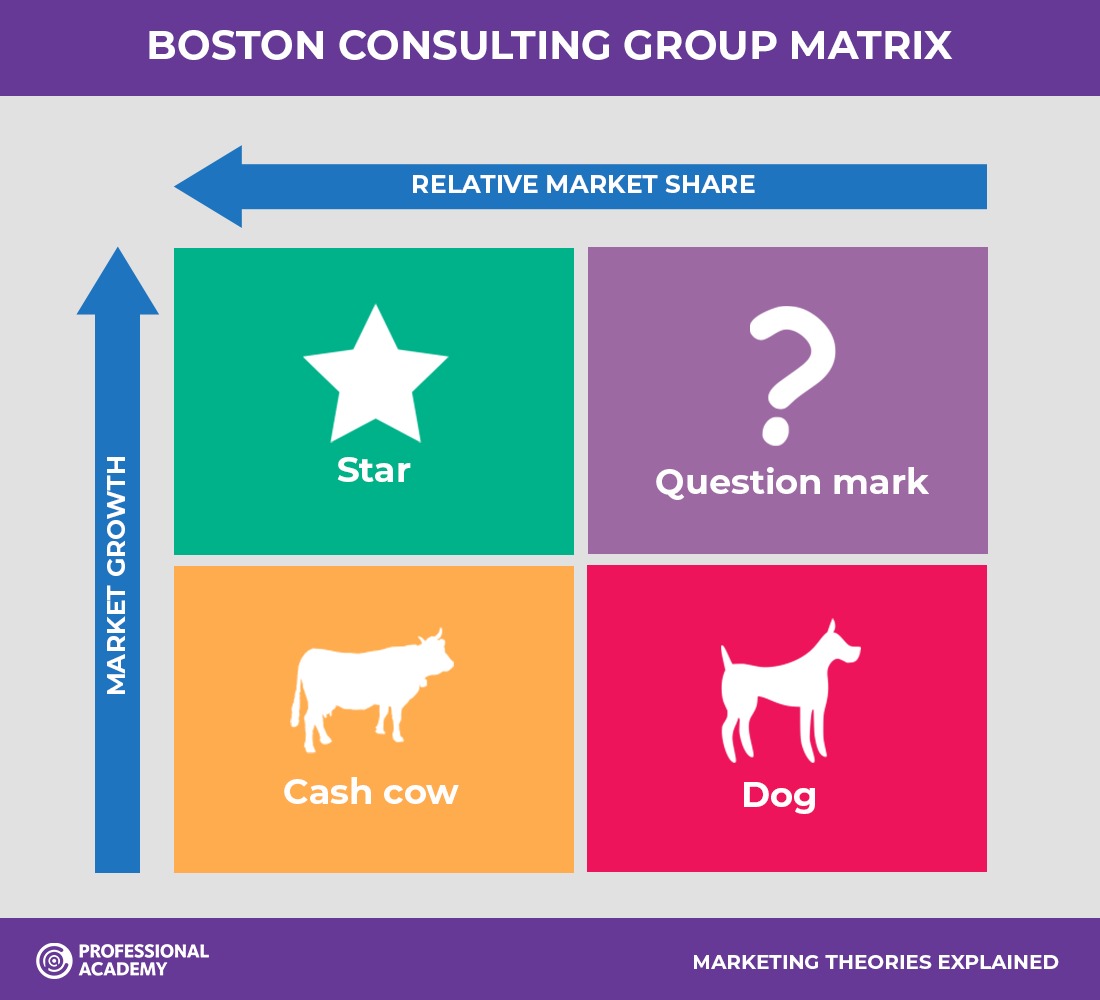

Strategic choices: Retrenchment, divestiture, liquidationĬash cows. Therefore, it is always important to perform deeper analysis of each brand or SBU to make sure they are not worth investing in or have to be divested. Some dogs may be profitable for long period of time, they may provide synergies for other brands or SBUs or simple act as a defense to counter competitors moves. In general, they are not worth investing in because they generate low or negative cash returns. Dogs hold low market share compared to competitors and operate in a slowly growing market. There are four quadrants into which firms brands are classified:ĭogs.

Therefore, business units that operate in rapid growth industries are cash users and are worth investing in only when they are expected to grow or maintain market share in the future. High market growth rate means higher earnings and sometimes profits but it also consumes lots of cash, which is used as investment to stimulate further growth. Nonetheless, it is worth to note that some firms may experience the same benefits with lower production outputs and lower market share. This is because a firm that produces more, benefits from higher economies of scale and experience curve, which results in higher profits. Higher corporate’s market share results in higher cash returns. One of the dimensions used to evaluate business portfolio is relative market share. The general purpose of the analysis is to help understand, which brands the firm should invest in and which ones should be divested. These two dimensions reveal likely profitability of the business portfolio in terms of cash needed to support that unit and cash generated by it. It classifies business portfolio into four categories based on industry attractiveness (growth rate of that industry) and competitive position (relative market share). Understanding the toolīCG matrix is a framework created by Boston Consulting Group to evaluate the strategic position of the business brand portfolio and its potential. Growth-share matrix is a business tool, which uses relative market share and industry growth rate factors to evaluate the potential of business brand portfolio and suggest further investment strategies. BCG matrix (or growth-share matrix) is a corporate planning tool, which is used to portray firm’s brand portfolio or SBUs on a quadrant along relative market share axis (horizontal axis) and speed of market growth (vertical axis) axis.

0 kommentar(er)

0 kommentar(er)